Atlendis News | May 2022

Atlendis News | May 2022

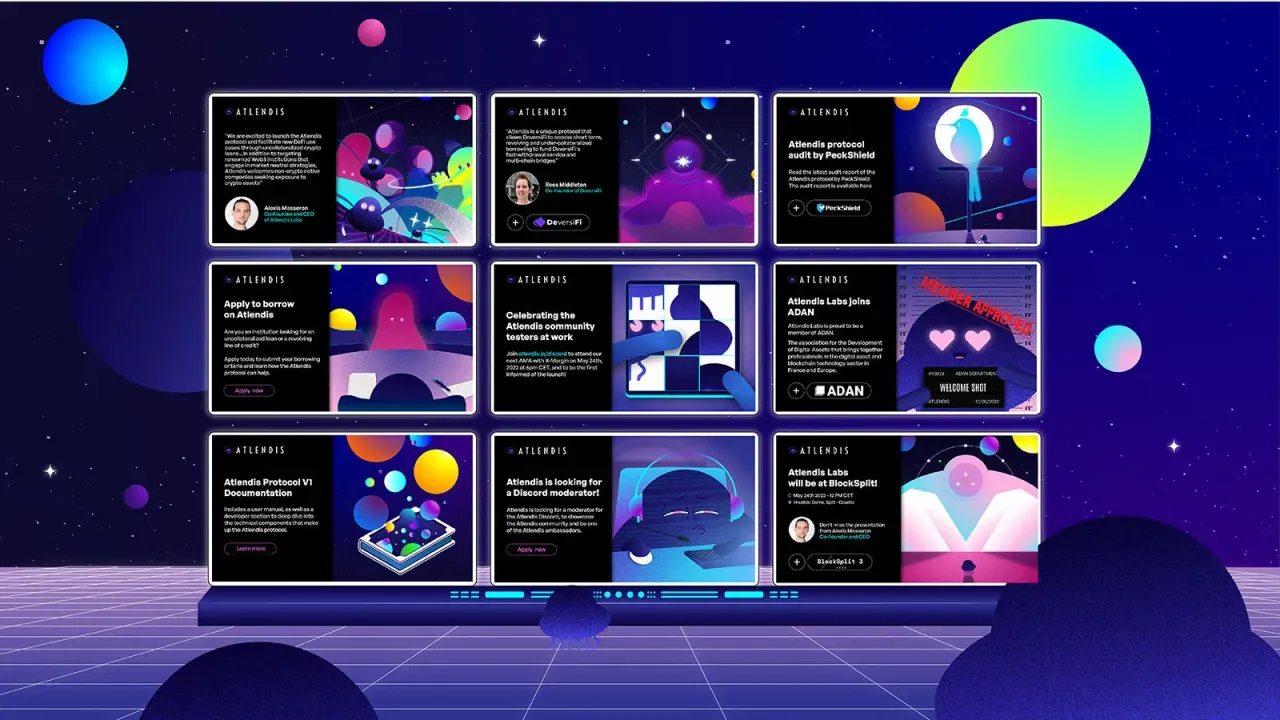

Read the latest edition of the Atlendis Labs newsletter and stay up to date on the exciting news and events in May from across the Atlendis World.

Atlendis Labs is excited to share a summary of the biggest news in May, including the latest updates and some reading recommendations.

What happened at Atlendis Labs…

Once again, the Atlendis World has been busy over the month of May! So here is an overview of the main news:

- Atlendis Labs’ CEO and Co-Founder Alexis Masseron gave a presentation on uncollateralized lending at BlockSplit on May 24th.

- Atlendis Labs hired PeckShield to audit the smart contracts of the Atlendis Protocol and it was successfully concluded over the course of May. Only medium severity issues (severity of 4 out of 6) were found and subsequently addressed by the Atlendis Labs technical team. The actual audit report is available here.

- Cryptotesters, a layer-2 native community made up of builders, investors, researchers and crypto enthusiasts launched 2,000 community membership NFTs and dropped a few Atlendis themed testers like this one here. We thank you Cryptotesters!

- On May 18, Atlendis Labs announced the imminent launch of a testing environment of the Atlendis protocol and the community claimed the first 100 spots within one hour. The testing environment has successfully onboarded its first testers on Kovan on Monday, May 23 and has since then been opening it up to more testers in the community.

- Atlendis and Cryptotesters joined forces during the testing phase of the Atlendis protocol with Atlendis opening tester spots for the Cryptotester community to test the Atlendis protocol and collect early feedback.

- Credora’s Co-Founder and CEO Darshan Vaidya was alongside Atlendis Labs’ Co-Founder and Chief Research Officer Charlotte Eli to discuss credit scoring in Web3 and answer the community’s questions during Atlendis’ third community call. The highlight article and a YouTube audio are available on Atlendis’ website.

What’s next?

- Atlendis Labs will be hosting “The Future of France” event together with friends in the French blockchain ecosystem and ADAN, kick starting EthCC Paris in a magical venue on July 18. Follow Atlendis Labs’ Twitter to learn more and receive updates.

- More testing spots will be opened to the community soon, join Atlendis’ Discord to be among the first informed and get to know the Atlendis community!

Featuring Atlendis in May 2022

Goldman Sachs accepte Bitcoin comme collatéral d'un prêt, by Christophe Auffray for Coins.fr.

“For the financial institution, BTC-backed loans nevertheless represent a further step in favor of the democratization of digital assets, and Goldman Sachs should continue its adoption. […] This is suggested by Damien Vanderwilt, co-president of Galaxy Digital. A French startup, Atlendis Labs, is also preparing the launch of a DeFi protocol for lending under-collateralized crypto to institutions.”

Reading Recommendations

- Twitter thread on how Web3 can benefit from UCLs, by Alexis Masseron

- The Hitchhiker’s Guide to Ethereum, by Jon Charbonneau for Delphi

“All roads lead to the endgame of centralized block production, decentralized trustless block validation, and censorship resistance. Ethereum’s roadmap has this vision square in its sights.

Ethereum aims to be the ultimate unified DA and settlement layer – massively decentralized and secure at the base with scalable computation on top. This condenses cryptographic assumptions to one robust layer."

- Two Thoughts Experiments to Evaluate Automated Stablecoins, by Vitalik Buterin

“What happens if we look at a stablecoin from the bold and radical perspective that the system's ability to avoid collapsing and losing huge amounts of user funds should not depend on a constant influx of new users? Let's see and find out!”

- Thread on the Soulbound Tokens paper by Vitalik

- How to Value DeFi Tokens, Bankless

"In venture capital and on Wall Street, we evaluate an investment’s expected returns by forecasting the asset’s financial performance and assuming it trades at some multiple of revenue or EBITDA on exit.

The surprising aspect is that we can apply this exact framework to many revenue-generating protocols to create an investment case for the traditional investor. In this post, I’ll give a teardown on MakerDAO."

Additional Resources

Atlendis.io | Whitepaper | LinkedIn | Twitter | Discord | Newsletter | Audit reports 1 and 2