An Overview of Lending: From TradFi, to DeFi, to Atlendis

An Overview of Lending: From TradFi, to DeFi, to Atlendis

Learn about Atlendis and its surrounding ecosystem at a high level from TradFi, to DeFi to Atlendis! Atlendis: DeFi protocol for uncollateralized lending.

This article will attempt to define the Atlendis protocol and map its surrounding ecosystem at a high level, to present an intuitive and holistic approach to Atlendis, its long-term vision, and plan for educational content. First things first, Atlendis is a capital-efficient DeFi protocol for uncollateralized lending.

By considering each block separately, this article will clarify the concepts of collateral and collateralization, lending (both in TradFi and DeFi) and capital efficiency. This will demonstrate where the Atlendis protocol places itself.

Abbreviations and definitions may be found at the bottom of the article.

Uncollateralized

Collateralization in finance is the use of a valuable asset of the borrower to secure a loan. The valuable asset used as such is called collateral, and in case of default of the borrower, the lender may seize the borrower’s collateral. This event can be followed by an auction during which the borrower’s collateral is sold to reimburse the lender. Typical examples of using collateral in traditional finance (TradFi) are mortgages, where the lender (a bank) can ultimately seize the borrower’s house in case of payment default.

In practice however, not all loans are secured, or otherwise tied to collateral. Actually, a lot of the lending happening in traditional finance is unsecured, such as bank overdraft, student loans, credit cards, or personal loans. Unsecured loans are often referred to as uncollateralized or zero-collateral loans.

What is lending and why is it so important?

Looking at it on a microeconomics scale, lending is the financial service by which one entity — such as an individual, business or institution — creates debt. Specifically thanks to uncollateralized lending, a borrower can take on more debt than their net worth to finance a project. On a macroeconomics scale, access to credit determines who and what can grow at a faster pace than their non-leveraged counterpart.

These are the effects of leverage, which is the use of debt to amplify or multiply the returns from an investment or an activity.

From a social, economical and political standpoint, it is a striking observation that a borrower’s capacity to access credit constitutes a discriminating factor that has clear micro and macro-economical repercussions.

Loan terms

When taking out a loan in traditional finance, the lender (a bank or financial institution) will assess the borrower’s solvency, or capacity to repay the loan, by deriving a credit score from the borrower’s banking history and the risk stemming from loan terms: amount, repayment installment, interest rate, and maturity. Today, most lenders use algorithms that will make the decision to grant the borrower credit permission or not.

Next, this article will describe how lending translates in the world of decentralized finance (DeFi).

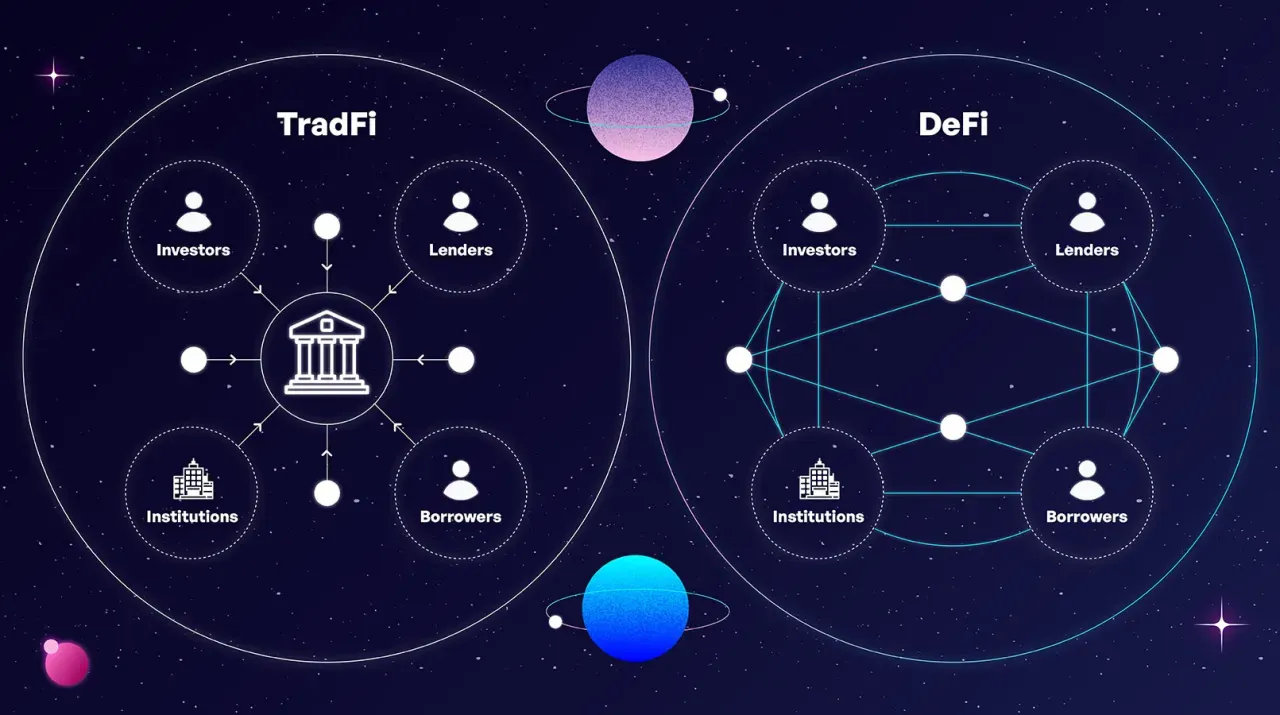

From TradFi to DeFi

Traditional finance relies on old infrastructures that are outdated in many technological respects.

DeFi is a growing ecosystem of decentralized applications known as dApps* that leverage blockchain technology to implement and disintermediate traditional finance banking services: deposit accounts, lending and borrowing, insurance, trading, etc.

DeFi has experienced huge growth over the past two years. According to defillama.com, TVL* in DeFi was at $0.7 billion in January 2020, growing 3500% to $25 billion a year later, and another 820% to reach $230 billion in January 2022.

Numerous upsides of blockchain technology explain why many believe that DeFi will not only catch up with, but overcome traditional finance: it removes third-parties from financial transactions (disintermediation), gives users ownership over their assets (non-custodial), it is distributed (nodes are geographically spread out and governance tends towards decentralization), transparent (a public ledger, open source code is the norm), fast, and, since all states of blockchains can be derived from one node, its resiliency to attacks.

DeFi is finally thriving as it is permissionless: anyone can create a crypto wallet and access decentralized finance, provided they have an internet connection and the appropriate hardware. Considering that about 1.7 billion individuals remain unbanked today, any collapsing barrier to entry is great news.

What is the Status of Lending in DeFi?

World debt is estimated to be upwards of $250 trillion, while total lending in DeFi currently sits at around $40 billion.

According to S&P Global Ranking’s Chief Analytical Officer:

"Lending volumes [in DeFi] are small but growing. We estimate that debt outstanding is slightly in excess of $30 billion, which represents a few basis points of global banks’ total lending. As of October 28, 2021, DeFi lending and borrowing protocols made up about 18 percent of the total DeFi market measured by market capitalization. The three leading DeFi lending and borrowing platforms (Aave, Maker and Compound) had a total market capitalization of about $8 billion as of the same date. This showcases the concentration of the lending and borrowing markets within DeFi."

To derive the potential of DeFi lending, let’s look beyond the crypto space and draw a parallel between TradFi and DeFi: according to the Institute of International Finance, in 2020 the world’s total money supply and total stock market caps summed up to $185 trillion. The same year, global debt amounted to $253 trillion. The ratio of debt to market cap is 137%.

Looking at DeFi now, if native tokens like BTC and ETH constitute money supply and tokens like AAVE or UNI the stocks, DeFi’s total market cap sits at around $2.6 trillion in January 2022. Only $40 billion is estimated to be debt. Therefore, DeFi debt is only 1.5% of its market cap.

Capital Efficiency

Limited debt emission in DeFi translates into DeFi capital being mostly inefficient. Since loans on the blockchain are commonly secured by over-collateralization, the ecosystem is overflowing with idle capital stored in crypto wallets, locked in smart contracts, or held by protocols and DAO treasuries. As protocols like Compound require borrowers to lock in collateral to obtain a loan, consequently many protocols and DAOs struggle to fund their operations and cannot use debt as a funding option, therefore they lack recurring sources of liquidity to meet their growing needs.

The Atlendis Protocol

Summary: Uncollateralized lending is a financial service milestone, allowing one to borrow more than they own, leveraging at scale and increasing capital efficiency. TradFi has been the stronghold of uncollateralized lending in a custodial, privately owned, centralized banking network. DeFi is the result of transposing TradFi services into a relatively decentralized, public, mostly open source, non-custodial based ecosystem. Because of the difficulty to assess a borrower’s solvency on the blockchain, DeFi lending so far has been reduced to overcollateralized lending use cases.

A look at the future of DeFi in the Atlendis World

The Atlendis protocol helps fill this gap by providing technological innovations for uncollateralized lending on Ethereum, although research is not limited to Ethereum mainnet. The Atlendis protocol will facilitate lending to whitelisted institutional borrowers to begin with. Think of the Atlendis protocol as a boosting infrastructure for DeFi networks, providing new options to optimize liquidity.

How it Works

Anyone can deposit liquidity on the Atlendis protocol and become a liquidity provider. Liquidities are pooled separately for each borrower, and for each asset.

Lenders | liquidity providers | depositors can thus choose the borrower that best meets their risk criteria. They also decide at what interest rate they wish to lend their funds, so that rates are set by the lending market on-chain (on the blockchain), through an innovative algorithm that will be revealed upon launching.

For borrowers, once whitelisted, the Atlendis protocol becomes a portal where liquidity is siloed and made readily available for borrowing. The maximum borrowable amount and maturity are determined upon whitelisting, as well as a liquidity fee – called liquidity reward for lenders – on unused capital in their pool (like commitment fees for unused credit lines in TradFi). Similar to a revolving line of credit, the Atlendis protocol offers a crypto credit line in the form of a liquidity pool that the borrower can withdraw from at any time.

The liquidity fees on unused capital and interest rates on used capital are distributed to lenders.

Atlendis will help connect retail investors on the blockchain with institutional borrowers from DeFi and outwards. Use cases are plentiful: lend to DEXes to improve market efficiency (indeed liquidity stimulates arbitrage activity, which, in turn, enhances market efficiency), offer DAOs new debt solutions for treasury management, loans to bridges for fast withdrawals from one blockchain to another...

The protocol rewards lenders with a premium on the basic deposit interest rate while maintaining granularity and agency in their investment strategy, and borrowers with a flexible and capital-efficient funding option.

Atlendis has all the tools to become the main liquidity facilitator and uncollateralized lending protocol in DeFi.

What the Atlendis Protocol Stands For and What’s Next

The Atlendis protocol purposefully builds as much of its mechanics/protocol on-chain, as Atlendis values the blockchain’s technological edge brought to topics such as decentralization, permission, transparency and disintermediation.

Since lenders' agency comes with responsibilities, Atlendis Labs will emphasize educational content, and share as many resources as possible to enable the use of the Atlendis protocol and DeFi in full knowledge. This will be the foundation to grow the Atlendis community at large.

What’s Next?

Don’t miss the first Atlendis Labs community call for an AMA on Tuesday, February 1st on Discord.

Follow Atlendis Labs' Twitter and Discord for announcements on upcoming updates, community calls, tutorials and support documentation.

But also educational content on a wide range of topics; from technical to philosophical debates on finance’s liquidity and market efficiency, DeFi’s case for zero-collateral lending, fast withdrawal and more.

Be the first to receive news and updates on the Atlendis protocol here.

Abbreviations

- AMA: Ask Me Anything; a community call where a host, guest or both answer any question from the audience related to the AMA’s theme.

- Arbitrage: is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded.

- CEX: Centralized exchange.

- dApp: Decentralized application.

- DeFi: Decentralized finance.

- DEX: Decentralized exchange.

- Mortgage: refers to a loan used to purchase or maintain real estate. The borrower agrees to pay the lender over time, while the property serves as collateral to secure the loan.

- TradFi: Traditional finance.

- TVL: Total value locked in DeFi smart contracts.

Sources

Global Debt Reaches a Record $226 Trillion (IMF)

The Coming Crisis in the Decentralized Lending Market (BeInCrypto)

Decentralized finance will change your understanding of financial systems (Forbes)

DeFi lending when will it threaten traditional lenders (International Banker)